The CryptoCurrency market continues to soar in popularity as more and more people jump to invest in cryptocurrencies and multiply their money. As the number of investors rises, so do the doubts regarding various terms associated with the CryptoCurrency market. One of the most commonly asked questions that people search for is – What is Volume Cryptocurrency in the Blockchain Technology?

The digital frontier of finance, cryptocurrency, is a dynamic ecosystem in which quantities scream faster than prices & trends come and go. Understanding such fragmented environment requires an understanding of “volume” in the context of cryptocurrencies. We explore the nuances of cryptocurrency volume, its importance, and its impact on the markets in this blog post.

If you are wondering about What is Volume Cryptocurrency in the Blockchain Technology, we urge you to read this article for complete information.

What does volume mean on a cryptocurrency exchange?

What is Volume Cryptocurrency in the Blockchain Technology?The Crypto market represents similar volatility as the traditional stock market, even surpassing it sometimes. Therefore correctly predicting the movement of cryptocurrencies is essential to make a profitable position and multiply the investment. Various technical indicators are employed to ascertain the trends of the prices. Volume represents one of the most important technical indicators for technical market analysis.

The volume of the CryptoCurrency represents how much a particular coin is traded over a given period on an exchange. Understand it this way – assume a scenario where a particular coin is not traded a single time. In this case, the volume of that coin will be zero. If it exchanges hands twice, the volume will be two times the value of that coin and so on.

In other words, the volume represents the strength of a CryptoCurrency and therefore also denotes the popularity of a given coin. The higher the volume, the more transactions are carried out, representing a general interest in the given CryptoCurrency.

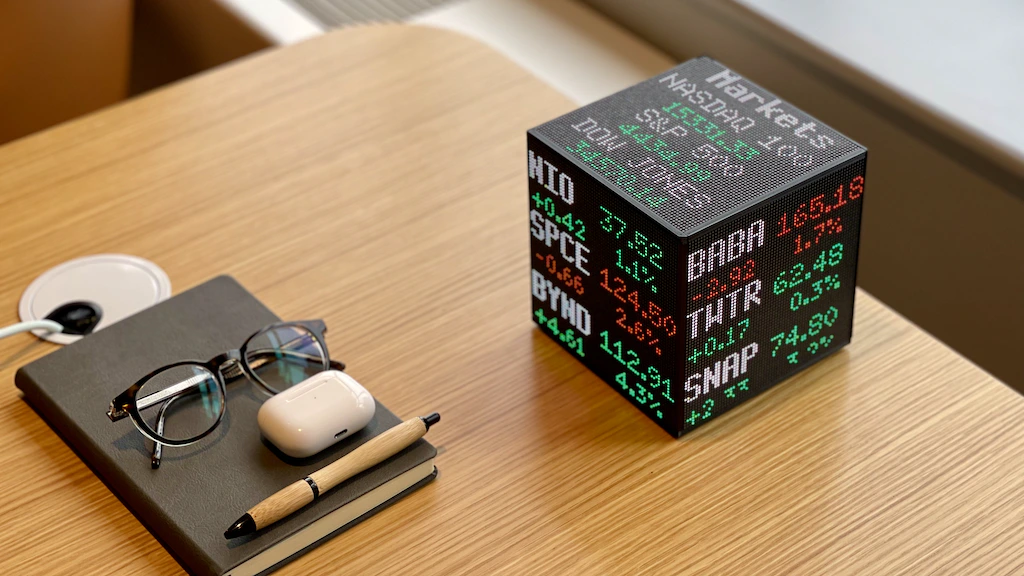

On a histogram, volume is denoted with green and red vertical bars. The height of the bar represents the extent of the volume. Green bar represents higher trading and a rise in the price, while the red bar indicates a fall in trading and a decline in price.

Why is the volume of cryptocurrencies so important?

What is Volume Cryptocurrency in the Blockchain Technology? Volume in a Cryptocurrency is a critical indicator that certainly facilitates decision-making while investing in a particular coin. Moreover, the volume represents the interest and intensity of market trends. The correct analysis of volumes offers valuable insight into the price movements and the source of price changes.

Cryptocurrency trading volume is an essential tool used extensively by veteran investors. Therefore it denotes a valuable factor in predicting the market trends and helping investors decide to enter or exit the market. If you are serious about crypto trading, you must learn to decipher the data represented by the volume so that your investment has a higher chance of giving a huge return.

Interpreting Trading Patterns

Trading patterns and cryptocurrency volume are closely related. A spike in volume during a trend, whether positive or negative, might reveal how strongly the market is feeling. Quantity assessment is widely used by traders to validate trends, spot possible reversals, or determine how strongly the market is moving.

Spotting Market Trends

When it comes to identifying new market trends, volume analysis is essential. When volume rises during a price climb, it might be an indication of strengthening interest and participation, whereas falling volume during a gain could reflect a weakening trend. Volume is one underlying primary instruments which investors use to confirm or refute the validity of a market trend.

Challenges and Considerations

What is Volume Cryptocurrency in the Blockchain Technology? Although volume analysis provides insightful information, it is important to consider potential problems. The reliability of volume data can be distorted by wash trading, a process in which traders buy and sell to create false volume. Additionally, liquidity can vary between trading pairs, impacting the reliability of volume as an indicator.

Final Thoughts

What is Volume Cryptocurrency in the Blockchain Technology? In the vast and often turbulent sea of digital assets, the amount of cryptocurrencies serves as a compass. It sheds light on market dynamics and provides investors and traders with important information that they can use to make smart decisions. As the cryptocurrency landscape continues to evolve, a thorough understanding of the interplay between volume and price fluctuations has become increasingly important for individuals traversing the frontiers of decentralized finance. Knowing what Bitcoin volume means can help you better understand market behavior and patterns, whether you’re an experienced trader or just a curious trader.