Businesses are always looking for smarter, faster, and cheaper ways to run their operations because the economy is so unstable right now. More pressure is put on working efficiency by rising prices, smaller budgets, and changing rules and regulations.

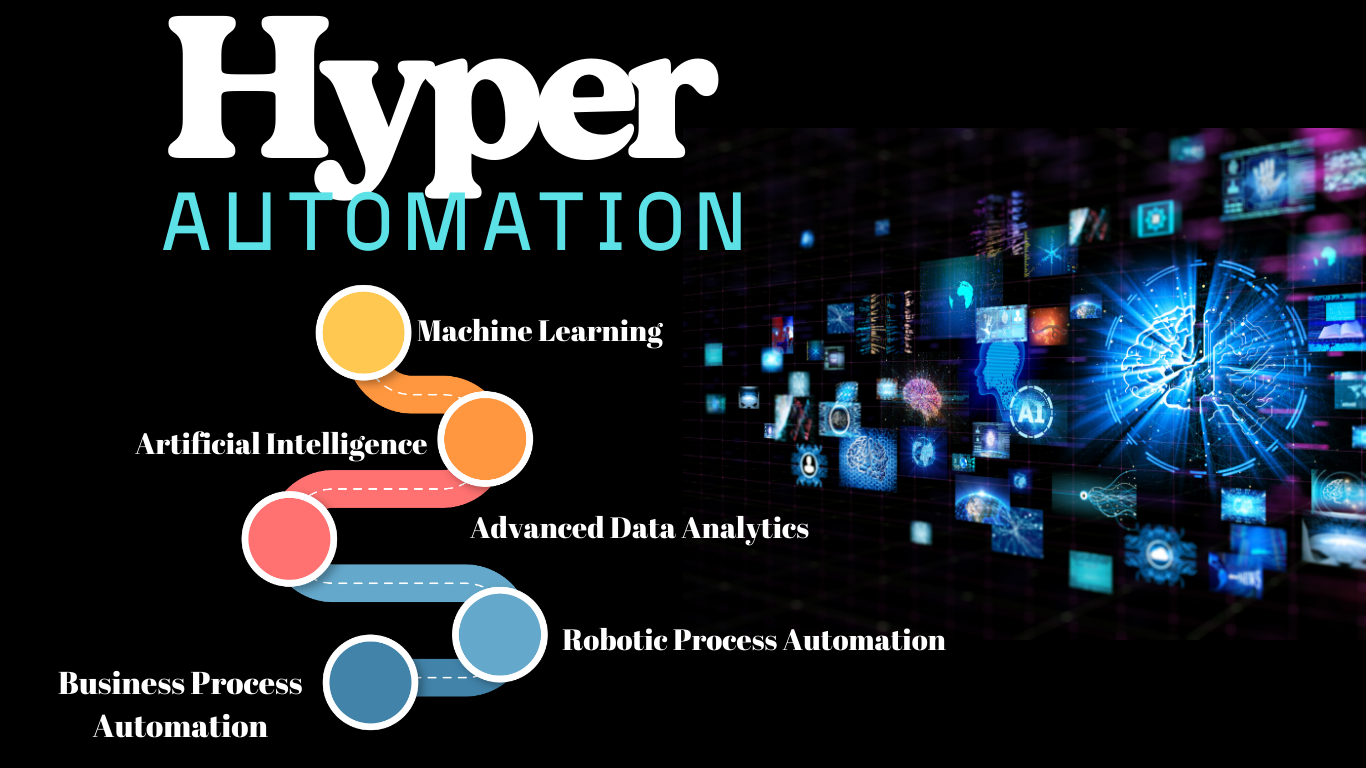

Here comes hyper automation, a planned, all-encompassing type of automation that combines cutting-edge technologies like AI, machine learning (ML), robotic process automation (RPA), process mining, and intelligent document processing (IDP).

What is the point of hyper-automation?

To change the way organisations work and automate as many jobs and processes as possible from start to finish.

What Is Hyper automation?

Traditional automation only works on single, repetitive jobs. Hyper-automation, on the other hand, covers the whole workflow of an organisation. It uses a bunch of different technologies—RPA, AI, low-code platforms, and smart systems—to find complicated business processes, automate them, and keep making them better.

Key factors include:

- Experts who know how to do things are important factors.

- Data about operations and how different platforms work together.

- Tools for automating tasks, such as RPA and process engines.

- The ability to learn and make choices with the help of AI and ML.

Businesses can change quickly, stay strong, and beat the competition thanks to this powerful combination.

Why 2025 Is the Year of Hyper automation

The move towards hyper-automation is mainly caused by two things:

- Pressures on the Economy and Operational Efficiency

Firms need to do more with less as costs rise. Hyper-automation helps by cutting down on manual work, lowering the chance of mistakes, and simplifying processes. This speeds up work and makes it more productive. - The Rise of Generative AI (GenAI)

GenAI has given intelligent technology a new lease on life. It makes it possible for machines to do hard jobs that older machine learning models had a hard time with, like extracting contract clauses or understanding complex document patterns.

Fiserv Is a Leader in Hyper-Automation in the Financial Services Industry

Tech company for financial services Fiserv is a great example of how powerful hyper-automation can be in the real world:

- Contract Data Extraction: Fiserv uses AI agents and UiPath RPA bots to fully automate the process of extracting service-level agreement (SLA) data from contracts. This data includes performance metrics, penalty fees, and vendor responsibilities.

- Changing with GenAI: Older machine learning models had trouble finding contract information that was spread out. GenAI, on the other hand, can now find this kind of secret data, which means automation can work in places it couldn’t before.

- Looking Ahead: Fiserv is also looking into contract hyper-automation that goes beyond SLAs. The goal is to find and match up invoices with missed price terms, like changes to the Consumer Price Index. This could stop money from leaking out and make sure that the money is spent correctly.

Hyper-Automation in Financial Services Will Have a Wider Effect

Hyper-automation gives banking firms more power in more ways than just Fiserv:

- Document Processing at Scale

Platforms can accurately scan and automatically process loan forms and handwritten documents, cutting in half the amount of work that needs to be done by hand and greatly increasing productivity. - FP&A and Intelligent Data Processing (IDP)

Tools automatically remove, clean, and organise financial data from reports, receipts, and contracts. This helps with real-time insights, finding outliers, and making predictions. - Fraud Detection and Smart Decision-Making

Hyper-automation brings together data from emails, databases, and outside sources to find patterns and report fraud before it happens. This makes replies faster and compliance stronger.

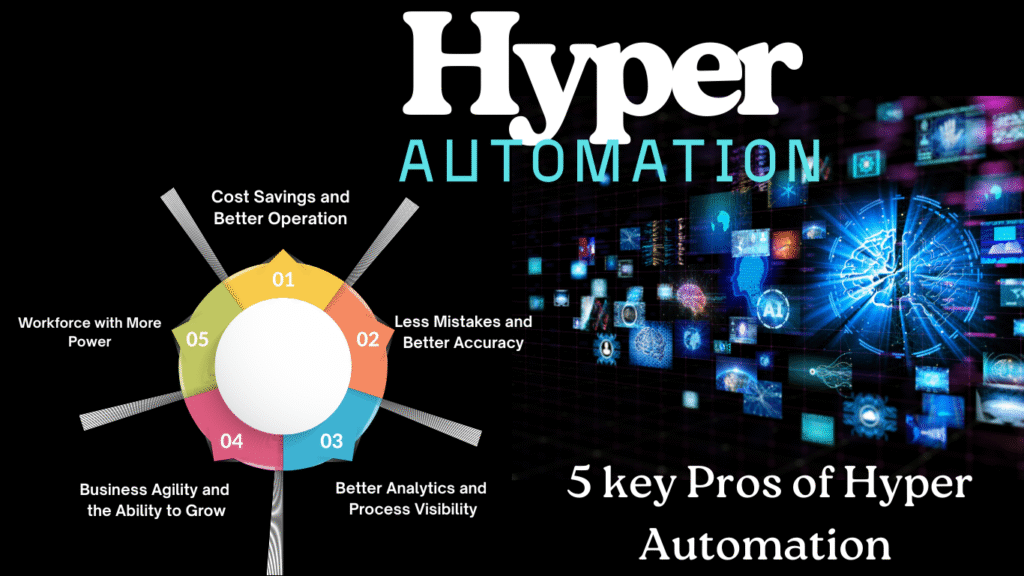

The Main Pros of Hyper-Automation

Here are the most important benefits that hyper-automation brings to banking services:

- Cost Savings and Better Operation

Automating jobs that are done over and over again speeds up work and cuts down on resource costs. - Less Mistakes and Better Accuracy

By using AI for deep data validation, intelligent automation cuts down on human mistake. - Better Analytics and Process Visibility

Monitoring tools help businesses find inefficient processes and keep getting better by iterating and improving all the time. - Business Agility and the Ability to Grow

Automated systems can respond more quickly to changes in the environment, such as new customer wants or changes in compliance rules. - Workforce with More Power

When bots do boring jobs, people can do more important work like strategic analysis and building relationships.

A Roadmap for Putting Hyper-Automation to Work

Here is a plan for organisations that are ready to accept hyper-automation:

- Find and Set Priorities

Do job and process audits (for example, process mining) to find the most valuable automation targets. Set rules-based, repetitive, or data-heavy jobs as priorities. - Start and Connect

Combining GenAI, IDP, and RPA tools can help you start with specific use cases, such as extracting contracts or handling invoices. Check the ROI and try again. - Develop and Set Up

A management layer to control how work is done across RPA, AI, data, and APIs. Spread across areas to get rid of compartments. - Watch and Improve

To keep track of the effects, improve bots, and make automation go even further, use process analytics and speed benchmarks. - Controlling and Overseeing People

Set rules for using AI tools and data ethics, and make sure that humans and bots can still work together.

Conclusion

Hyper-automation, which is needed for economic reasons and is made possible by GenAI’s transformative abilities, makes banking services much more efficient. Companies like Fiserv show us how AI-powered automation can solve long-standing problems, like finding hidden contract terms and processing documents quickly and correctly.

When financial companies use AI, RPA, and intelligent integration, they do more than just streamline their processes. They also make it possible for proactive, smart, and resilient business models.